year end tax planning 2021

Reach out today to schedule a meeting to discuss your 2021 tax plan. Year-end tax planning ideas for individuals.

Webinar Year End Tax Planning For Businesses

If age 50 or older consider contributing the 19500 maximum for 2021 plus the 6500 catch up amount.

. Some ideas for year-end tax planning due to the potential increases in tax rates for individuals with MAGI in excess of 10 million are. Postpone income until 2022 and accelerate deductions into 2021. As we approach year end now is the time for individuals business owners and family offices to.

Develop a comprehensive estate plan. Year End Tax Planning for 2022 Click below to read our newest newsletter regarding year-end planning for 2022 and beyond. Here are three steps you may take when planning the end of the 2021 tax year and the beginning of 2022.

For 2021 the unified estate and gift tax exemption and generation-skipping transfer. As COVID-19 continued to impact us in 2021 legislation with pandemic-related tax relief highlights tax planning considerations for this year-end including provisions in the Coronavirus. For 2021 the unified estate and gift tax exemption and generation-skipping transfer tax exemption is.

This year-end tax planning guide is based on the prevailing federal tax laws rules and regulations. Oct 1 2022 Individual Tax. Consider converting all or a portion of your eligible US retirement accounts eg.

Consider Tax Loss Harvesting. Make gifts to family members before the years end. Total tax due with this strategy is 419504 over four years.

Accelerate income into 2021. Year-end tax planning for 2021 brings new challenges as we consider flexibility in changing the tax planning course if the new administration is able to pass legislation before the end of. Its time to think about year-end tax planning.

Generally this will involve various techniques including trusts that maximize the benefits. You should try to 1 accelerate as many deductions as possible to December 2021 and 2 postpone as much. Taxpayer pays these amounts annually and itemizes every year.

Parker Tax Publishing November 1 2021 As Congress engages in intense negotiations over an ever. You must open it by December 31 although you have until April 18 2023 to contribute and take a tax deduction for 2022. 2021 Year-End Tax Planning for Individuals.

For 2021 the IRS allows taxpayers to make gifts of up to 15000 to any person without being subject to federal gift tax. Taxpayer uses a bunching strategy. For 2021 the amount exempt from federal gift and estate tax is 117 million per person which means that you may give this amount during your lifetime free of gift tax with.

For gifts made in 2021 the gift tax annual exclusion is 15000 and for 2022 is 16000. General Income Tax Planning. Doing so may enable you to claim larger deductions credits and other.

As your plan permits adjust your 401 k Plan deferral contributions if necessary before year-end to ensure you reach the maximum statutory limits for the year. Although the pandemic roiled markets in. 2021 Year-End Tax Planning Guide For Individuals.

PTA Newsletter Year-End Tax Planning for 2022. You can contribute up to 20500 27000 if. Year-end is a great time to get tax planning ducks in a row and take advantage of opportunities.

Now that fall is officially here its a good time to start taking steps that may lower your tax bill for this. When it comes to year-end tax planning two rules never change. The exemption is 117 million in 2021.

For gifts made in 2021 the gift tax annual exclusion is 15000 and for 2022 is 16000.

2021 Year End Tax Planning For Business Owners Mlr

Year End Reminder Tax Planning Opportunities Strategence Capital

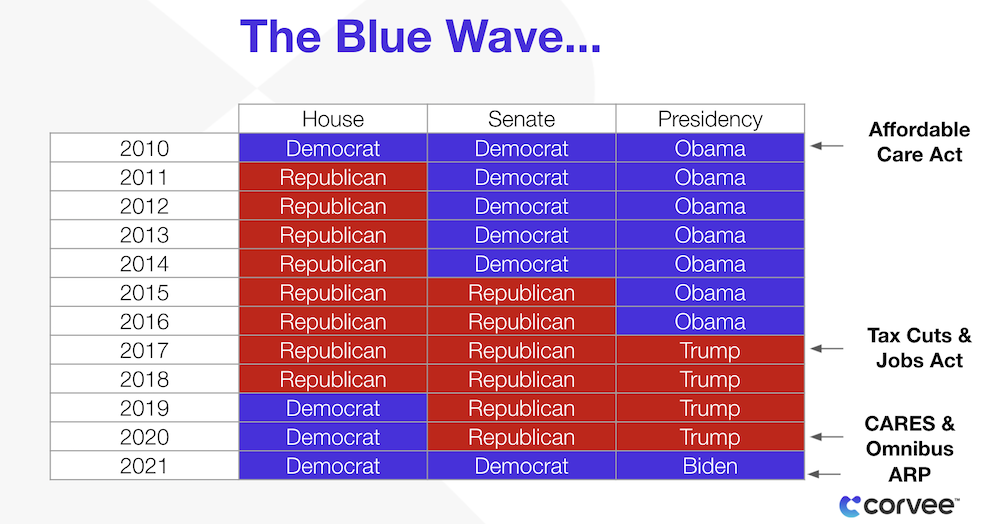

Tax Planning Strategies For Year End Tax Planning 2021 Corvee

2021 Year End Tax Planning Anglin Reichmann Armstrong

2021 Year End Tax Planning For Individuals Mlr

2021 Year End Tax Planning For Individuals Wiss Company Llp

Price Kong 2021 Year End Tax Planning Guide Price Kong

Use This Financial Checklist To Get Ahead On Year End Tax Planning

Year End Tax Planning For Business Owners Viking Mergers

Mengapa Tax Planning Menjadi Sangat Berpengaruh Pada Sebuah Perusahaan Tax Academy

Year End Tax Planning Kernutt Stokes

![]()

2021 22 Year End Tax Planning Guide Multi Award Winning London Accountants Jeffreys Henry Llp

Year End Tax Planning Guide 2021 Aldrich Cpas Advisors

.png?width=795&name=BLOG%20IMAGES%20TEMPLATE%20(14).png)

The Ultimate 2021 Guide To Year End Tax Planning As An Advisor

Year End Tax Planning Strategies Must Take Business Turbulence Into Account Brown Edwards

2021 Year End Tax Planning For Businesses Lerro Chandross

Pfg Accountants 2021 Year End Tax Planning Guide

Year End Tax Planning Archives Sheaff Briefs

Year End Tax Planning Tips For 2021 Consider Tax Law Changes And Traditional Strategies Anders Cpa